Badlands Media will always put out our content for free, but you can support us by becoming a paid subscriber to this newsletter. Help our collective of citizen journalists take back the narrative from the MSM. We are the news now.

The public is starting to become aware of just how powerful some of these multinational investment companies are. The most popular among these companies is BlackRock, Inc., which just so happens to be partnered with Klaus Schwab’s World Economic Forum.

If you were to look at a list of the biggest shareholders of any given major parent company, you tend to see the same names at the top of the institutional holders list: Blackrock, Inc, and the Vanguard Group, among several others. These are the two largest investment companies in the world.

To really hammer home just how pervasive these groups are, let's consider the perspective of the average consumer.

Say you’re going to your local supermarket to pick up some orange juice. For this example, let’s say you’re in Western Michigan and you’re shopping at a FamilyFare. Typically, you’re going to be presented with at least two options for your OJ: Minute Made or Tropicana. Both of these orange juice brands are subsidiaries of larger corporations. In this case, Minute Made is owned by The Coca-Cola Company, and Tropicana is largely owned by PepsiCo. (#)(#)

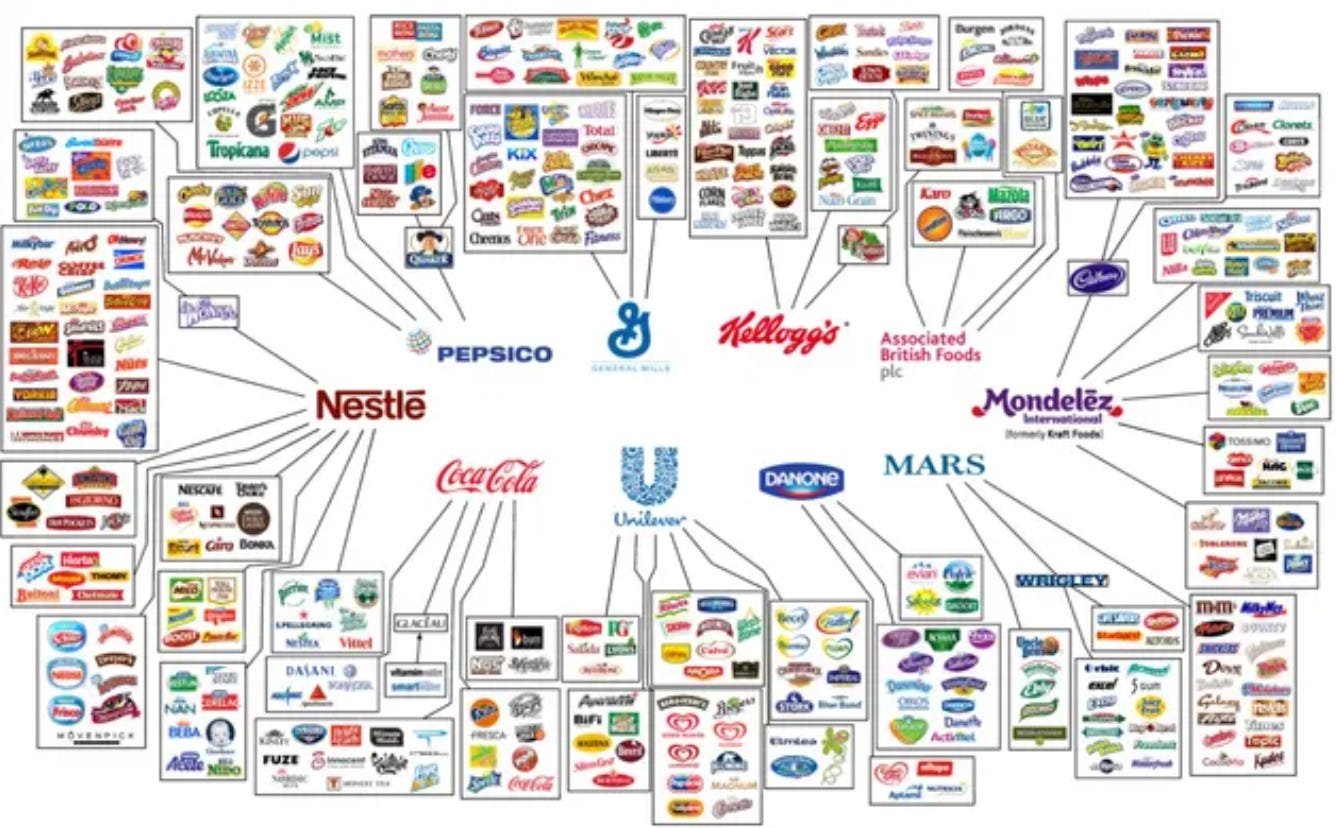

Both of these companies are in the S&P 500 index, meaning they are among the 500 biggest companies in the world. (#) It’s worth noting that all packaged food brands are owned by a dozen or so larger parent companies. Pepsi Co. owns a long list of food, beverage, and snack brands, as do Coca-Cola, Nestle, General Mills, Kellogg's, Unilever, Mars, Kraft Heinz, Mondelez, Danone and Associated British Foods.

Together, these parent companies monopolize the packaged food industry, as virtually every food brand you find at a typical supermarket belongs to one of them.

So all the big brands are owned by bigger megacorporations, but in a sense, these megacorporations could also be seen as subsidiaries of their largest investors. If you were to look up the primary shareholders of any given corporation, you might notice that the top institutional shareholders are, more often than not The Vanguard Group and Blackrock, Inc.

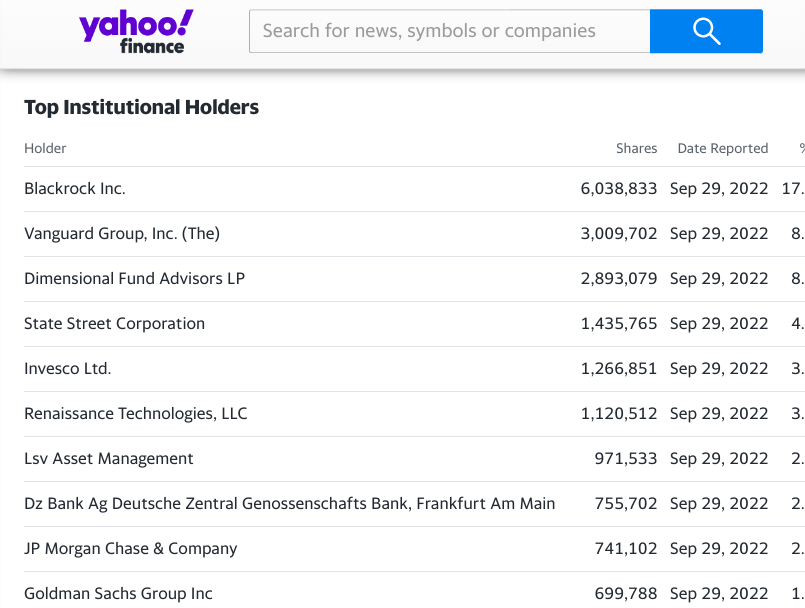

Here’s a list of PepsiCo’s top institutional investors:

If you run the same check on the Coca-Cola Company, you’ll find both names at the top of that list as well (just below Bill Gates and Warren Buffet’s Berkshire Hathaway.) (#)(#)

What’s more, the supermarket itself is owned by a parent company. In this case, FamilyFare is owned by SpartanNash, and if you were to take a peek at who the top investors in SpartanNash are … you guessed it: Blackrock, Inc., and the Vanguard Group. (#)

Let’s put the food industry talk on hold for just a moment and have a discussion about why you should even care. The inner workings of Vanguard are a little more obscure, so let’s focus on BlackRock for a minute.

BlackRock is an enormously powerful company that a majority of Americans know little to nothing about. The company manages almost $10 trillion in assets, and the vast majority of its investing is done “passively,” which means that the money is invested in indexes of stocks and no stock-by-stock selection occurs. BlackRock manages money for larger-than-life institutions as well as pensions. Just about everyone reading this probably has money, or at least knows someone who has money, directly or indirectly in a BlackRock account. (#)

Even though BlackRock “passively” invests for most clients, it still wields unprecedented power, both over the companies whose shares it holds and by using them to affect the American economy.

Great effort has been expended attempting to downplay this reality.

BlackRock may not be the ultimate owner of the shares it manages, but it can and does vote on those shares on behalf of its clients. That tremendous voting power enables BlackRock to exert extraordinary influence over corporate management and policy. We’re not talking about mom-and-pop shops here either; the corporations in question are often behemoths like Exxon and Microsoft. Moreover, BlackRock functions in an intensely oligopolistic environment.

There are only three other asset managers—Fidelity, Vanguard and State Street—that even come close to competing with BlackRock in size and heft. Not only is Blackrock the biggest of them all, but it’s also a major shareholder in the others.

Of course, across the surface internet, you’ll hear all about how these companies only manage assets and that there is nothing nefarious going on, but that is absolutely and demonstrably not true.

Here are a couple of examples: In Q3 of 2021, BlackRock opposed the re-election of 800 separate company directors. (#) Last year, American oil company Exxon dropped several drilling projects due to BlackRock removing board members and installing new members, despite the globe objectively being underinvested in energy production. If your gas costs more, it’s thanks in part to BlackRock. (#)

Why would they do this? Absent some sort of agenda, this behavior doesn't make sense financially or logistically.

Many do not realize it, but BlackRock is also a major contributor to the dominance of leftism in corporate America. The company seems to have no reservations about using its power to promote left-wing political priorities. (#)

BlackRock figurehead Larry Fink wrote recently in the New York Times that “rich countries must put more taxpayer money to work in driving the net-zero transition abroad,” noting that “[a]chieving the net-zero transition” by 2050 “will require unprecedented levels of investment in technology and infrastructure.”

BlackRock is also the leading contributor to the economy’s monopoly problem. In a healthy competition-based economy, the largest companies in a single industry should still be competing with each other head-to-head on the price and quality of their products. But BlackRock and the other big asset managers have “cross-holdings” in all of the largest players in the industry, a consequence of passive investing. It’s called “horizontal shareholding” and it is eroding competition. (#)

If you happen to be a millennial or older, then many of the greatest corporate rivalries of your childhood are now essentially a facade. Whether it’s Coke vs. Pepsi, Right Aid vs. Walgreens, CNN vs. Fox, or Ford vs. Chevrolet, it doesn't matter anymore, because Blackrock and Vanguard win no matter which company ends up on top.

As we mentioned earlier, horizontal shareholding has completely deteriorated any sense of competition. This was analyzed in the airline industry, and a compelling paper was written. When two airline companies compete, they tend to lower prices for certain routes to draw in more customers, but when horizontal shareholding becomes the norm, there is no need for lower ticket prices because the shareholders win whoever the customer chooses. This doesn't just affect ticket prices, it changes everything about the company, most notably the quality of service. So if your air carrier loses your bags, provides shoddy service, or charges you too much, you can thank BlackRock! (#)(#)

So then the question now is this: if these two companies are the top shareholders of nearly every major corporation, who exactly owns the largest shares of Blackrock and Vanguard? The answer is none other than ::drumroll:: Blackrock and Vanguard!

Now that you have more of an idea of how BlackRock operates, let’s consider a couple of other critical industries.

Take a wild guess at what the New York Times has in common with Pfizer.

That’s right, Blackrock and Vanguard are the top shareholders of both companies, by far. (#)(#) The implications of this are staggering, especially considering how powerful both the media and pharmaceutical industries are.

We see above that 94.42% of NYT’s shares are held by institutional holders, and of those holders, BlackRock and Vanguard sit at the top. The same is true of Pfizer.

As we mentioned earlier, these two parent companies monopolize the packaged food industry. Now it’s starting to look like they dominate the pharmaceutical industry and the media that reports on it as well. (We’ll support these claims by taking a deeper look at these industries momentarily.)

Can you guess why this might be cause for concern?

Consider the quality of most of these packaged food brands. It’s not some wild stretch to say that these foods are some of the leading causes of obesity, heart disease and many other ailments. If the packaged food companies that these investment managers oversee benefit from the sale of addicting processed foods, and the medical/pharmaceutical companies benefit from having a large pool of unhealthy citizens to treat, then what incentive is there for BlackRock or Vanguard to suggest their clients make more healthy foods? After all, they put heavy pressure on companies to conform to mostly unscientific climate alarmism; if they were so interested in benefiting humanity, then why don’t they force these brands to make healthier products?

What other extremely important and influential industries could we look at? Why don’t we take a quick gander at who owns the establishment media apparatus?

Most people are aware that roughly 90% of the media is owned by only 6 corporate conglomerates. (#) The big 6 include Comcast, Disney, Time Warner, News Corp, National Amusements and Sony. In 2022, it was declared that the big 6 had become the big 5, but for the sake of our argument, lets look at the 6. (#)

Under Comcast, you have NBC, Universal, Telemundo and many more. Naturally, Blackrock and Vanguard are their largest shareholders. (#) Disney’s ability to affect culture is quite profound, particularly with young women and children. Disney owns such assets as ABC, A&E, Marvel, ESPN and VICE, to name just a few. As with Comcast, BlackRock and Vanguard are also the largest shareholders of Disney (#). The same goes for AT&T, which owns Time Warner (CNN, Adult Swim, HBO, Warner Bros,)(#), and even News Corp (traded as NWSA), which owns Fox News, isn’t spared from these pervasive investment management companies. (#)

When you think of Big Tech, a few names tend to pop up. Meta, the company formerly known as Facebook is one of those names. Meta owns somewhere around 90 different tech companies, the most notable being Instagram, WhatsApp and Oculus VR. A quick search will show that their top institutional holders are, of course, the big 2. (#)(#) Facebook is big, but it’s not the biggest fish in the big-tech sea; that honor goes to Alphabet Inc. Alphabet owns Google, which means they also own YouTube, Waze, Fitbit and many others. I'm sure you don’t need me to tell you who the biggest shareholders of Alphabet, Inc. are. (#) (#) Blackrock and Vanguard’s interest in tech doesn't end there; they are also some of the largest shareholders in Apple, Microsoft, Intel and IBM. (#)(#)(#)(#)

The power of Big Tech to affect the mass consciousness, particularly through social media, is unprecedented. They can determine what information makes it into the spotlight and what type of information is considered taboo or shameful.

We’re going through all of these industries to lay out pieces of the puzzle, so please bare with me a little longer because the full picture is just starting to come into view.

We mentioned earlier that Blackrock and Vanguard are the largest shareholders in Pfizer, but how about other Big-Pharma brands? They also just so happen to be the largest shareholders of MonsantoBayer, Johnson & Johnson, Moderna and NovaVax. (#)(#)(#)(#)(#)

What do most of these companies have in common besides ownership? Most of them developed the experimental mRNA vaccines for COVID-19.(#)

You might be thinking, ‘So what? These companies save lives!’

But the unfortunate truth is that these big pharmaceutical companies have been caught knowingly pushing dangerous products time and time again. Consider Bayer, who recently merged with scandal-ridden Monsanto amid legal issues regarding the herbicide glyphosate; in the early 2000s, Bayer was caught selling AIDS-infected medicines overseas (#).

Johnson and Johnson has a troubled history as well, having been forced to recall baby powder after it was found to contain asbestos. (#) Yet despite this, many people were soundly convinced to trust them enough to inject experimental drugs into their arms without question.

So we have Blackrock/Vanguard-owned media convincing people of the efficacy of Blackrock/Vanguard-owned experimental drugs.

Are any implications coming to mind?

COVID-19 led to the largest upward transfer of wealth in all of human history.

The ten richest men in the world (at least on the books) each doubled their wealth during the pandemic. (#) Amazon CEO Jeff Bezos increased his wealth by $24bn in April 2020 alone.

While myriad small businesses were forced to close down forever, other businesses thrived. Small-town grocery stores were shuttered while BlackRock-owned supermarkets like Target and Walmart took on all their customers. Virtual meeting platforms such as Zoom, Google Hangouts and Microsoft saw explosive growth. Zoom in particular reached $663.5 million in the months of May–July 2019 alone.

Naturally, BlackRock and Vanguard are the largest shareholders of all of these companies. (#)(#)

Charity Oxfam released a remarkable report that laid bare the discrepancy between how much the world's largest companies profited as a direct result of the COVID-19 pandemic. According to the report, entitled “Power, Profits and the Pandemic,” 32 of some of the world’s largest companies saw profits jump by $109bn (£84.1bn) in 2020 alone, while globally more than half a billion people dropped below the poverty line. (#)

Is being the largest shareholder of various companies really worth our scorn? Surely they have the best interests of the people in mind, right?

Not exactly. In fact, much of BlackRock’s behavior actually harms the average American in more ways than anyone realizes.

We mentioned the thorough dominance of Big Media, Big Tech and Big Pharma. Having a monopoly over any of these given industries is a big deal, but having a stranglehold on all of them at once creates the potential for the world’s first truly global totalitarian dictatorship. Something that once felt like a fairy tale now seems more like an inevitability, with talk of social credit scores for individuals and ESG scores for businesses becoming commonplace.

What makes us believe that BlackRock has a role to play in this?

For starters, BlackRock’s founder and CEO, Larry Fink is a member of the World Economic Forum as well as the clandestine think tank of the ruling elite, the Council on Foreign Relations.

Both of these groups have made it abundantly clear that their goal is to create a one-world government by any means necessary; they have been telling us as much for years.

Perhaps it’s time we listened.

Badlands Media articles and features represent the opinions of the contributing authors and do not necessarily represent the views of Badlands Media itself.

If you enjoyed this contribution to Badlands Media, please consider checking out more of my work for free at Underground Newswire.

People can still hold power over them. If for 2 weeks, all people united and didn’t buy anything from any of these companies, didn’t travel or use our phones and internet, their shares would drop in value and we would control the economy. A social strike on their economy.

Printing the graphic. Going to make a strong commitment to no longer buy the products.

I'm sharing as much as I can. Praying people would wake up and LISTEN.

May this media outlet be blessed and carry on to educate and help us who don't have time to investigate. Thank you for helping us understand.