Nobel-Winning Economist Revives 2013's Ridiculous 'Platinum Trill'

"The Treasury gets to decide ..."

Badlands Media will always put out our content for free, but you can support us by becoming a paid subscriber to this newsletter. Help our collective of citizen journalists take back the narrative from the MSM. We are the news now.

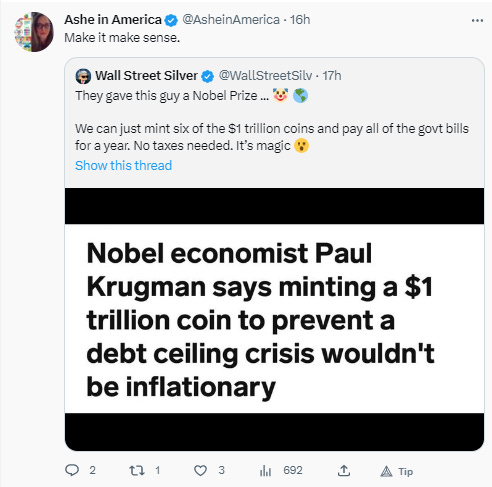

“Make it make sense.”

That was the tweet, and it was in response to the “$1 Trillion coin” theory that is making the rounds again, more than a decade after its inception and original promotion during the Obama Administration.

On Wednesday, Wall Street Silver posted, “They gave this guy a Nobel Prize ... 🤡🌎. We can just mint six of the $1 trillion coins and pay all of the govt bills for a year. No taxes needed. It’s magic 😮”

Again, someone — please — make it make sense.

Who is Paul Krugman?

Paul Robin Krugman is an American economist with an extensive resume. He is the author or editor of 27 books spanning economic theory, academic textbooks, and general texts for broader public audiences. He authored more than 200 scholarly works in professional journals, and he is a “celebrated” columnist for The New York Times, Fortune and Slate.

At 70 years old, Krugman is the Distinguished Professor of Economics at the Graduate Center of the City University of New York. Earlier in his career, Krugman was an economics professor at MIT and, later, at Princeton University. He retired from Princeton in June 2015, and retains his title of professor emeritus. He also holds the title of Centennial Professor at the London School of Economics.

Krugman is considered to be among the most influential economists in the world and, as Wall Street Silver shared, in 2008 he was awarded the Nobel Prize in Economic Sciences for his contributions to New Trade Theory and New Economic Geography.

According to a Forbes piece in 2008, “Countries gain from trade not only because larger market allows them to better exploit scale economies, but also because consumers can access a larger variety of products … A hallmark of Krugman’s work is parsimony. His models are among the most elegant: lean and thin and transparent. They have all the required parts but no unnecessary fat.”

It’s just globalism, and much of Krugman’s work focused on rationalizing his model’s obvious conflict between centralization and high transport costs:

“... Krugman combined this simple model of product differentiation and scale economies with transport costs. Scale economies push toward production in one location to minimize costs and then shipping the product to the locations where consumers are. But transport costs push toward locating production near consumers. These opposing forces give rise to large concentrations of populations such as those along the East Coast corridor of the United States. —Forbes

The Prize Committee celebrated this rationalization, awarded Krugman the Nobel … and globalism went to the moon.

Why are we talking about a 70-year-old economist?

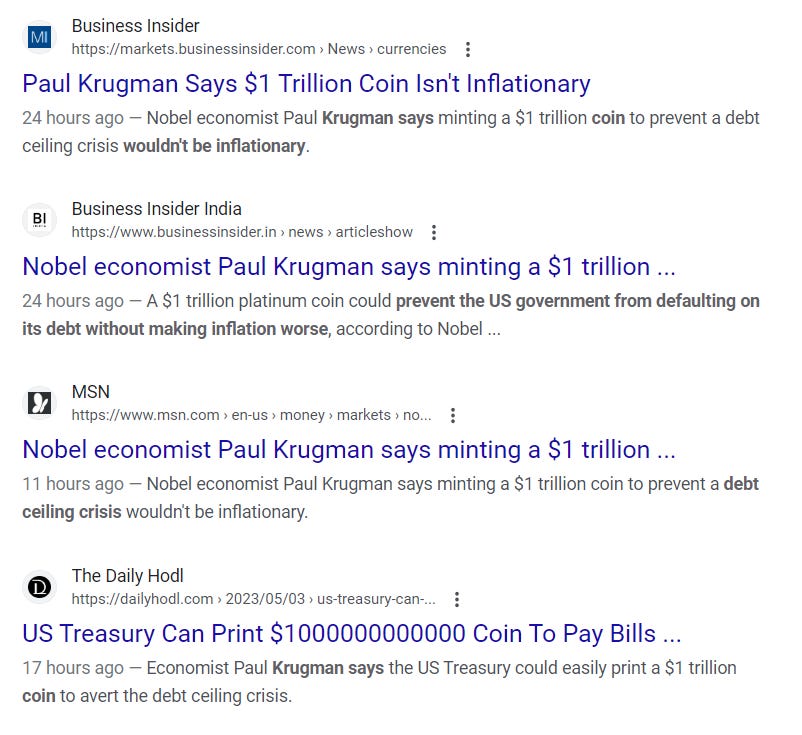

The economist that paved the way for the rapid expansion of globalism in the last decade is running his mouth again. He is reviving the trillion dollar coin debate — the theory that the Fed can mint a $1T coin to prevent a debt ceiling crisis.

And, this time, he claims it won’t be inflationary.

The Trillion-Dollar Coin Theory

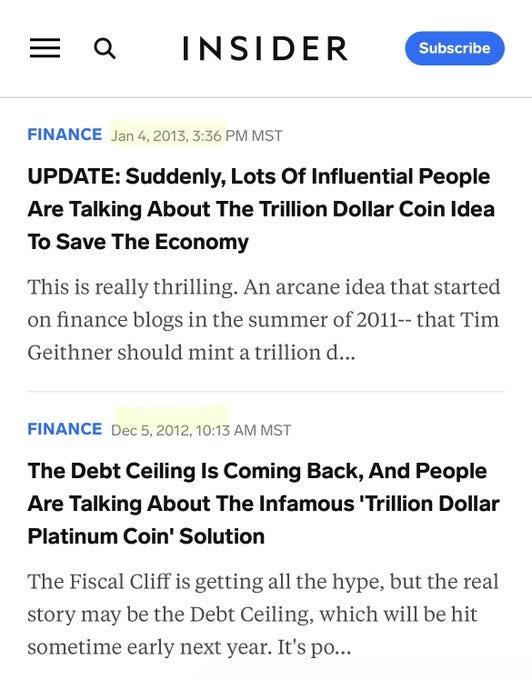

The first thing to realize is that this $1 Trillion coin debate is not new. From a January 2013 Business Insider article:

“This is really thrilling. An arcane idea that started on finance blogs in the summer of 2011– that Tim Geithner should mint a trillion dollar platinum coin to avert the debt ceiling – is now seriously taking off.” — Business Insider

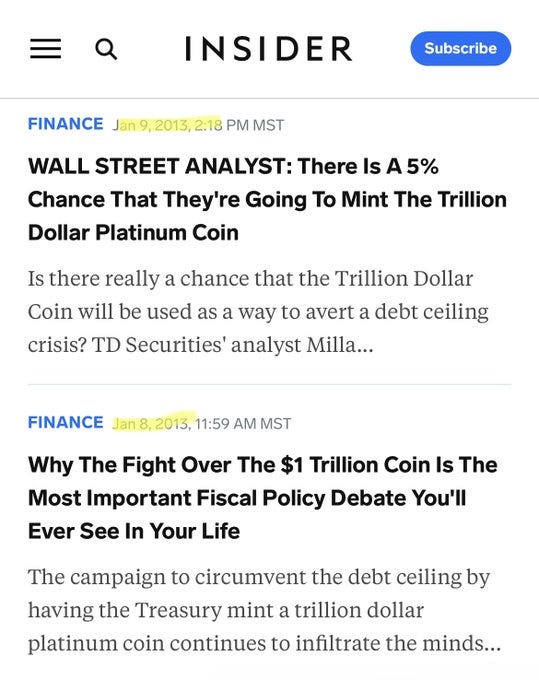

There were a flurry of articles in 2013 pushing the $1 Trillion coin theory.

Even so, Krugman’s peers at the time gave the idea low probability:

"Minting a $1T coin: Outside of an agreement, there are other options available to the [Obama] White House to avoid a default. There appears to be some serious consideration being given to the minting of a $1T coin as a plausible alternative to a default. If this is done, it could effectively provide additional room for funding government operation without the need for incurring new debt. This is akin to debt monetization. Probability 5%." — Millan Mulraine, TD Securities Analyst (2013)

What I find most fascinating is that the economic geniuses at Insider didn’t ask basic questions about how this would work. This ‘trust the experts’ mentality of journalists goes back a long way.

From December 2012, one of the earlier mainstream pieces on the theory:

“The gist is that the Treasury is allowed to unilaterally mint platinum coins. It could create a $1 trillion coin, and deposit it at its account at The Federal Reserve. It sounds completely crazy, but ... it's even crazier to think that the U.S. would default arbitrarily just because of a dumb law. So if the choice is between default and a trillion dollar platinum coin, we endorse the coin all the way. And we're glad to see people talking about it.” (emphasis added) — Insider

Who is Gresham and What is His Law?

If your brain feels like it’s going to explode, then you’re where I was when I posited the original question/statement on Twitter, “Make it make sense.”

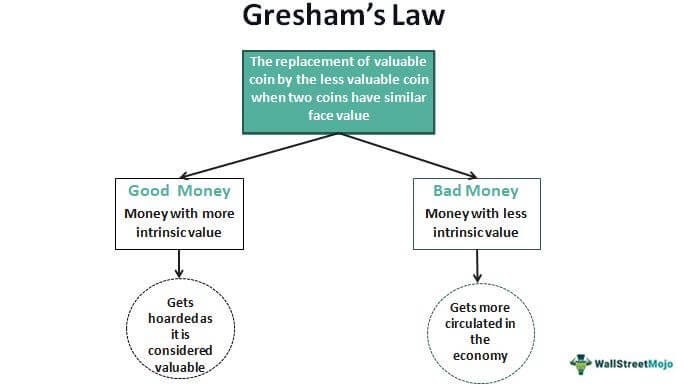

Most in the comments shared my confusion, but then BTC Citadel XXl jumped in to try and help me out by posting Gresham’s Law.

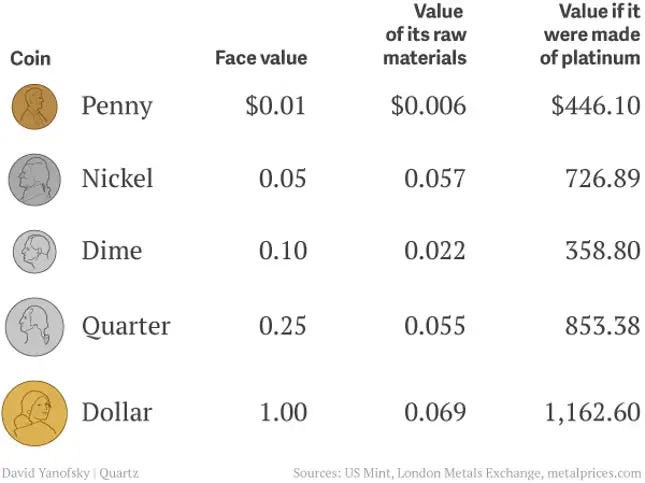

Gresham's Law is the idea that "bad money drives out good,” or that if there are two forms of currency in circulation, eventually the one with greater intrinsic value will drive out the one with the lesser intrinsic value.

This obviously isn’t the law to which Insider was referring in 2013, but it’s certainly relevant to the debate.

From Investopedia:

“Sir Thomas Gresham lived from 1519 to 1579 and wrote about the value and minting of coins while working as a financier. Gresham's law is a principle that states that ‘bad money drives out good.’ The law observes that legally overvalued currency will drive legally undervalued currency out of circulation. The law observes the effects of currency debasement.” — “Gresham's Law: Definition, Effects, and Example” (2023)

Currency debasement means lowering the value of a currency and historically refers to mixing base metals into currencies that are made with precious metals. Debasement gives more money to governments for spending while citizens get inflation.

Since in modern times our currency is backed by nothing but hopes and dreams, debasement refers to the government printing money, increasing the supply of dollars by decreasing the spending power of each dollar.

How Big is This Coin?

According to the theory, if the trillion-dollar coin held greater intrinsic value than the dollar, then over time the new coin would replace the dollar. I have lots of questions about this, but top of mind was:

“What gives the $1T coin intrinsic value?”

Citadel had an answer:

“Intrinsic value is that it’s a $1T palladium coin. It’s good money that’s paying bad debt. But this is just a small band aid on a wound with fatal bleeding. But in theory I’m not sure if it would work because I don't know how much interest we owe on our debt.”

All of the news I’ve read on this refers to a platinum coin, but let’s set that aside for a minute and use palladium for the example. Palladium is a chemical element with the symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal, with a current (as of writing) market value of $1,427/oz.

My next question was, “How big is this coin?”

Citadel did the math:

“So this coin would be 700,770,847.933 oz and 3,743,434.02 square feet 💀.” That is 86 acres, at the thinness of a regular coin.

As I was contemplating my disbelief, dsbcrypto weighed in, “Not enough palladium exists KEK. When are CBs gonna say, ‘hey, ummm gold is 20k an ounce now thx bye,’ to which Citadel responded:

“That is right! I didn’t even consider that. In 2022, the global supply of palladium was forecast to be 7.12 million ounces. In 2021, the total supply of palladium amounted to seven million ounces worldwide.”

So, to make the $1T coin out of palladium, we would need – at least – 100x the actual supply of palladium on Earth.

But all the news is talking about the coin being composed of platinum. Could we make the giant coin out of platinum?

Well, as of writing, the value of platinum is $1,052.01/oz.

To make a $1T coin out of platinum, you would need 950,561,306.451 oz. Worse, from a supply standpoint, there is even less platinum on the planet than palladium. From Statista, “Preliminary figures for 2022 indicate a global platinum supply of around 5.2 million ounces.”

To make the coin out of platinum, we would need – again, at least – 183 times to global supply of platinum to make one $1T coin.

It’s Basically Magic

So, the $1T coin won’t actually be a coin composed of $1T worth of platinum because, all other issues aside, that much platinum doesn’t exist in the world.

Apparently, that doesn’t matter. According to a 2013 discussion, the actual value of the metal is irrelevant:

“A coin can be any size. The Treasury gets to decide a coin’s worth, and the value of the metal that comprises the coin doesn’t have anything to do with its value in currency.” — Quartz

Oh.

So, the whole plan here is to create normal-sized coins out of platinum and simply declare them worth one trillion dollars each? And according to Nobel award-winning economist Paul Krugman, that won’t be inflationary.

Fortunately, in January, Treasury Secretary Janet Yellen dismissed the $1T coin theory as a “gimmick”:

But in the past week, the idea is recirculating with mockingbird precision.

And, unfortunately, Yellen’s dismissal is largely irrelevant, since we are hostages to the private central banks, meaning, magically declaring $1T of value is not actually her decision:

"It truly is not by any means to be taken as a given that the Fed would do it, and I think especially with something that's a gimmick," Yellen told the Wall Street Journal in January. "The Fed is not required to accept it, there's no requirement on the part of the Fed. It's up to them what to do." — Fox News

I guess, as long as you trust the Federal Reserve, there is nothing to worry about.

Either way, Paul Krugman’s economic theory here hinges upon the central banks declaring value out of thin air. Not terribly surprising when you consider that the Nobel Prize in Economic Studies was established in 1968 … by Sweden's central bank.

Alfred Nobel is rolling in his grave.

Badlands Media articles and features represent the opinions of the contributing authors and do not necessarily represent the views of Badlands Media itself.

Ashe in America hosts Culture of Change on Badlands Media, Sundays at 6PM ET. If you enjoyed this contribution to Badlands Media, please consider checking out more of her work for free at Ashe in America.

Ah, the financial equivalent of the perpetual motion machine: we can get something out of nothing.

Krugman is a moron.

There. I said it.

This discussion assumes that the debt is valid and must be repaid. First it is not valid because it is based on fraud, and second, one cannot pay a debt with a debt. The system is already "magic", so any requirement from the government or federal reserve, will easily be answered with "bankruptcy", whether filed properly or not.

The intrinsic value of money is always determined by its weight and nothing else.