One of the Most Transformative Moments in Money Since Jekyll Island

Digital Assets, Personal Responsibility & the War for American Liberty

Badlands Media will always put out our content for free, but you can support us by becoming a paid subscriber to this newsletter. Help our collective of citizen journalists take back the narrative from the MSM. We are the news now.

“We’re not going kinetic. This is a peaceful revolution for everybody. Everybody gets ‘Digital 1776,’ everybody is going to be on the same playing field,” GMoney said, presumably atop a soapbox, during a recent episode of Rug Pull Radio on Badlands.

As Americans brace for the fall of the US dollar, advocates of decentralized finance are quick to sell emerging digital asset classes as the future.

The blockchain is going to save us.

DeFi will solve the myriad problems created by 100 years of central banking.

I agree on the problems. I agree that we need decentralized solutions. But I’ve always been skeptical that the answer is currency as code.

What Makes a Currency a Currency?

Currencies are currencies because they store value and function as a unit of exchange.

Currency’s six key attributes are scarcity, divisibility, acceptability, portability, durability, and uniformity, or resistance to counterfeiting.

From Investopedia:

“One can argue that Bitcoin's value is similar to that of precious metals. Both are limited in quantity and have select use cases. Precious metals like gold are used in industrial applications, while Bitcoin's underlying technology, the blockchain, has some applications across the financial services industries. Bitcoin's digital provenance means that it might even serve as a medium for retail transactions one day.”

“If the price of one bitcoin were to reach $514,000, Bitcoin's market capitalization would reach approximately 15% of the global currency market.”

- Investopedia, Why Do Bitcoins Have Value? (2022)

And that’s just Bitcoin.

Born From Corruption & Chaos

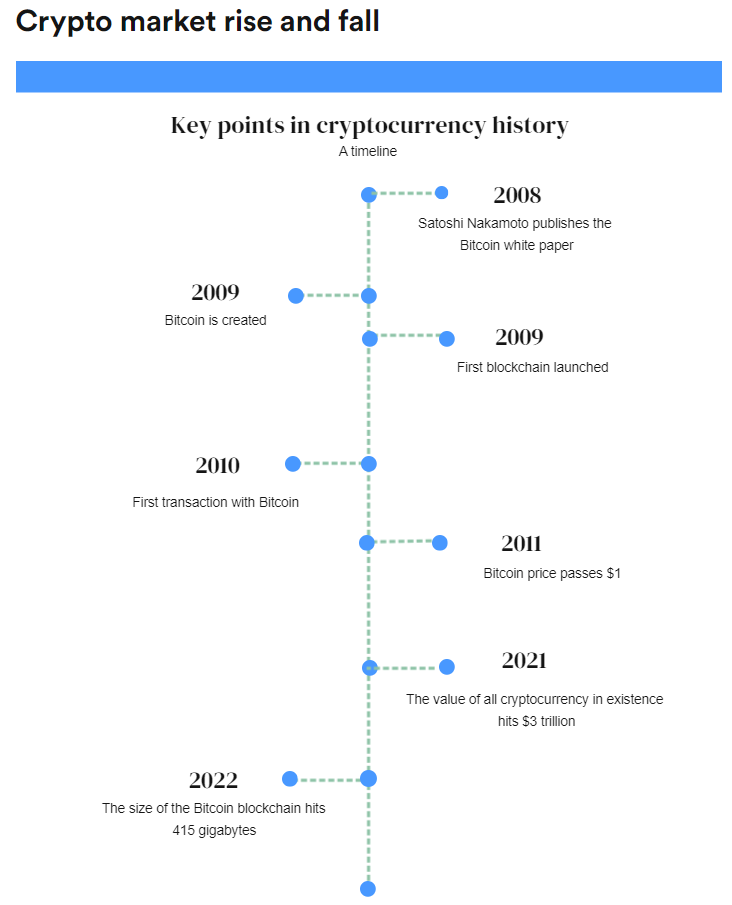

The 2008 financial crisis and the “Great Recession” were the primary catalysts for the rise of new digital asset classes over the last 10-15 years. As more people became aware of the power held by the central banks, solution-oriented innovators found a way to reclaim some of that power through decentralization and digitization.

Bitcoin’s first transaction was used for two Papa John’s pizzas. Its initial value was less than a penny ($0.0008 USD), hit $0.08 USD by the end of the month, and grew to more than $68,000 at its peak. At the time I write this, Bitcoin is sitting at $29,163.70.

It’s Your Money: Choose Your Fighter

According to a 2021 Pew Research study, only 16% of Americans had invested in, traded or otherwise used a crypto currency at that time. In the first Quarter of 2023, crypto ownership is down.

According to a Financial Health Network piece in March:

“After a tumultuous year in crypto, recent data suggest that cryptocurrency ownership has decreased following the collapse of the cryptocurrency market in late 2022. Only 11% of consumers currently hold cryptocurrencies or digital assets, according to a new survey collected by the Financial Health Network as part of its FinHealth Spend study. This represents a decrease from pre-collapse estimates of cryptocurrency ownership, which were between 16% and 17%.” — Financial Health Network FinHealth Spend study, conducted January 5-30, 2023, with 5,055 adults US-nationwide

A couple months ago, when I begrudgingly decided to learn currency-as-code (or, code-as-currency?), I set up a wallet. Just to see if I could, I purchased a small amount of Ethereum. I was then puzzled that I couldn’t move it because I didn't own enough to cover the transaction fee. And that’s how I learned about “gas fees.”

My meager holdings qualify me as part of the 11% of Americans participating in this space, even though I have zero idea (or, really, desire) to engage. Those highly engaged in the community–mining, developing projects, day trading – comprise far fewer.

Since those two Papa John’s pizzas were purchased, more than 21,000 different cryptocurrencies have come to be. Ethereum sits behind Bitcoin in both value and, ostensibly, trust:

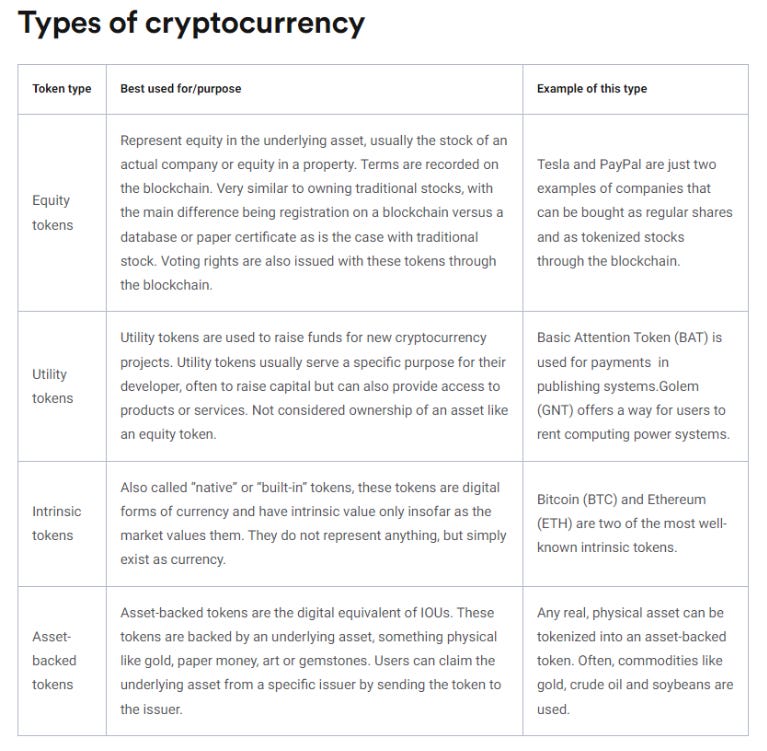

But there are many types of digital assets that make up this ecosystem:

Resisting the central bankers means resisting centralization, and these new asset classes play a role in that fight. Certainly, from an anarcho-capitalist standpoint, this is the moment to prove that your decentralized, largely unregulated utopian idea can work.

So, how is that going?

What’s DeFi?

“The first thing you need to understand is that there’s no such thing as ‘DeFi.’”

I had just asked Ryan Matta to define DeFi for me and talk about the culture of the crypto community.

Matta is an independent journalist who built a following covering crypto before being canceled for speaking the truth about global communism. A former robotics engineer, Matta was mining Ethereum at $2.64, and he holds strong opinions about the present and future of finance, which he discusses on his YouTube Channel, Ryan Matta.

“There is nothing decentralized about proof-of-stake blockchain,” Ryan said.

A proof-of-stake (POS) blockchain uses randomly selected validators to confirm transactions and create new blocks. This is compared to a proof-of-work (POW) blockchain, like that of Bitcoin, which uses competitive miners, or super computers that are designed to solve very complex mathematical problems, to confirm transactions and add new blocks to the blockchain.

The biggest criticisms of POW chains are speed and environmental impact. Bitcoin transactions are notoriously slow, and according to Bankrate,

“Bitcoin mining consumes so much electricity that it accounts for 0.40 percent of the entire world’s electricity consumption as of July 2022”

We are, of course, talking about the carbon footprint of Bitcoin, which is allegedly very large, at 22.9 million metric tons per year. If Bitcoin were a country, it would be in the top 30 energy users worldwide, according to globally-accepted climate change metrics (which are super real and totally not made up).

In September 2022, when Ethereum completed its move to POS–dubbed “the Merge”–they reportedly dropped their direct energy consumption by 99% while also increasing transaction speed.

But in solving for speed and environmental impact, they added greater centralization.

With POS, validators are chosen based on the number of staked coins they have. That can create barriers to fair access for retail investors, which Ryan covers in detail in his video “What is Solana?” from October 2022.

“When a project launches,” Ryan explained, “the team owns enough stake in the company to where they can control and change the rules of a blockchain.”

In a traditional market sense, that sounds like antitrust violations and market manipulation.

But in crypto, it’s just a Tuesday.

Fraud is Fraud … Right?

Big-dollar scams make the news. FTX and Alameda swindled an estimated $8 Billion from investors, and that scandal is still being covered in the mainstream press.

It’s crafted narrative and mocking-bird talking points, but it’s covered. “Authorities” pretend that they are going to hold people accountable, nothing happens, and then investors are scolded about informed investing and personal responsibility.

There may be a scapegoat, like Sam Bankman-Fried, but the whales, shadow players, and broader networks escape unscathed.

Smaller, lower dollar amount scams piss off a lot of retail investors, but because we aren’t talking about billions of dollars, these stories rarely make the news.

But fraud is still fraud, right? Theft is still theft?

Of course, but retail investors that get scammed for $20-30K have little recourse in a highly volatile asset class.

In 2022, DeFi saw “$3.6 Billion lost from all attacks on all project types,” according to CoinTelegraph. “This is an increase of 47.4% from the previous year's total of $2.4 Billion lost in security exploit related-incidents.”

In 2023, investors are fighting back, and scammers should beware:

If you steal from the wrong person, they just might start tracking your wallets and connecting dots.

“Done with the eth demons who ain’t building shit and using their friends as exit liquidity.”

The Wild West without the Cowboys

As a result of exploitation within the community, there is an effort among some retail investors to expose scammers. These investors-turned-investigators are discovering that many of these smaller scams are being executed by a well-coordinated network.

If you can prove it, you’ve got antitrust violations and market manipulation.

Just as with the large, government-sanctioned scams like FTX, the perpetrators have been getting away with it.

Consider the case of Saitama: A contract for Saitama Token (Saitama Inu) was created on the Ethereum Network on May 30, 2021 with an initial supply of 100 quadrillion tokens. Of those:

47.04 Q were burned (removed from the circulating supply)

46.06 Q were added to Uniswap (comprising tradable supply)

5.76 Q were reserved as “team tokens” (for the small handful running the project)

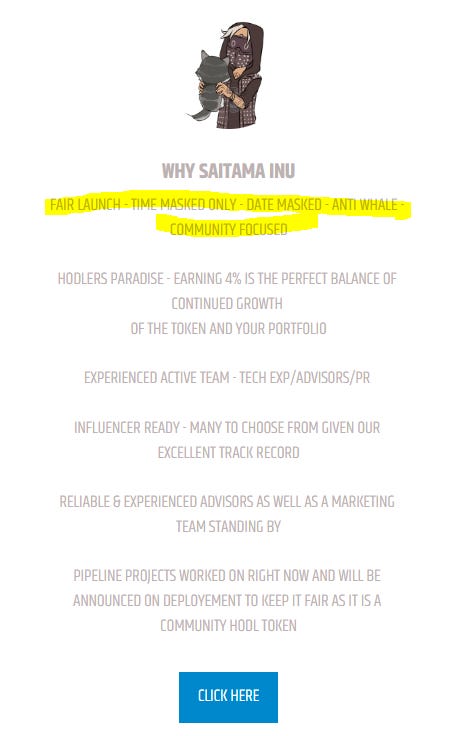

According to Sky, one of the investigators I spoke with, the Saitama project developers never disclosed the team tokens at the launch; rather, they claimed to have a fair launch on their website. The website is still up.

A “fair launch” refers to projects that provide everyone with an equal chance of acquiring tokens, no matter their status—that is, no one is privileged to an investment above any other. If you’re trying to be an informed and responsible investor, in a world of scammers and thieves, a project being fair launch would be a key factor in your decision or not to invest.

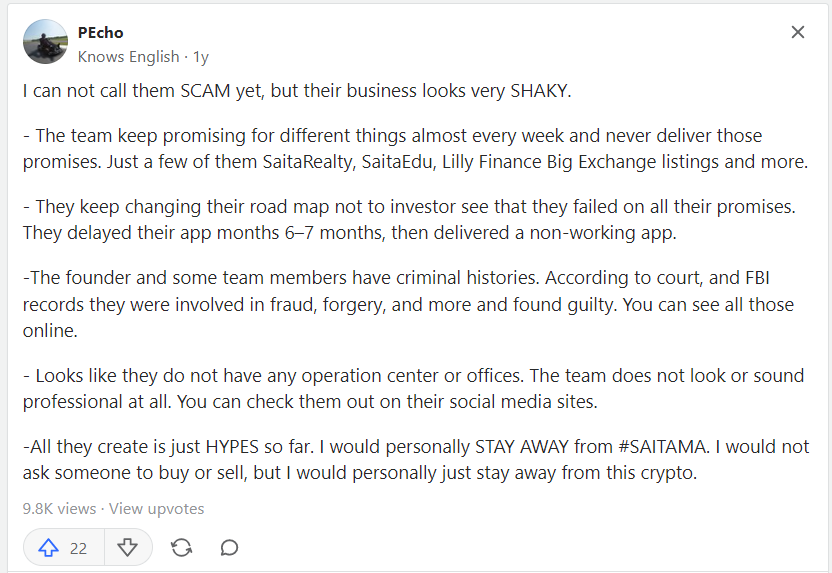

According to Sky, Saitama started as a meme coin and was “intended to rug since the beginning.” But calling a project fair launch while reserving team tokens is, in the traditional sense, a textbook case of misleading investors.

The team for which the undisclosed “team tokens” were reserved was small—around eight players. The original dev was known as “Mr. Saito,” and he allegedly handed over the project to the current embattled dev team.

The contract was renounced on June 5, 2021, less than a week after it launched, and the story goes that the Saitama team took the money and ran.

The way Sky tells it:

“The original deployer began moving the undisclosed reserve tokens from four main wallets through hundreds of sub wallets – which had already sold a lot – and some still hold close to 3 quadrillion. At least 1 quadrillion ended up directly on Gate.io and several more trillions on Bitmart, Lbank, and other exchanges. These moves were used to ‘hide the trace’ of the team tokens, but due to KYC limitations on the exchanges, they moved some to private wallets and sold from there on Uniswap.”

And they got caught.

I’m not a lawyer, but lying about having a fair launch while reserving, but not disclosing, team tokens sounds like a clear case of deliberately misleading investors — especially when those team tokens were, as Sky and the other investigators found, used to manipulate the market and defraud investors.

In the real world, if your business endeavor is created with the intent to defraud, and you get caught, you’re going to prison. In financial services, deliberately misleading investors is a violation of Section 10(b) of the Securities Exchange Act of 1934.

According to the SEC, “Victims in these cases have the right to recover their investment losses they suffered as a result of the fraud.”

While there has been no accountability for Saitama yet—and no recovery of investment losses suffered as a result of the fraud—Sky seems optimistic that there will be.

“I don't know the extent of the investigation, but 100% there are authorities looking into it–probably for the magnitude of the market cap of the project. In November 2021, it was close to 8 billion market cap, and the deployer is connected to multiple rug pulls.”

But justice takes time.

As Martin Luther King, Jr. said, “The arc of the moral universe is long, but it bends toward justice.”

Thankfully, in 2023, the community appears to be doing a better job of proactively policing themselves. But if the investment itself is a lie, then accountability must follow and, again, there are existing laws for this.

Unfortunately, that means government intervention, and governments are itching to lay claim to – and neutralize – the power of Bitcoin and other digital assets.

The Government is Here to Help

In March, Argentinean senators approved a $45 Billion bailout with the International Monetary Fund (IMF). The deal included a clause requiring Argentina “to discourage the use of cryptocurrencies with a view to preventing money laundering, informality, and disintermediation” in order to “further safeguard financial stability.”

The IMF Executive Board approved the deal on March 25 and, according to an AMBCrypto article from April 24:

“The anti-cryptocurrency requirement of the IMF underlines the ongoing debate about the position of digital assets in the global financial system. While some see cryptocurrencies as a way to promote financial inclusion and economic progress, others believe that these digital assets may encourage illegal activities, tax evasion, and financial instability.”

What they really mean is that “cryptocurrencies,” and specifically Bitcoin, are a threat to their centralized power.

“The financial systems, dependent mainly on banking institutions, in Europe and Asia may face financial stability risks following widespread substitution from bank deposits to crypto assets.”

Argentina’s IMF bailout deal includes a wild clause that rips cryptocurrencies Yahoo! Finance (2022)

In September 2021, El Salvador became the first country to make Bitcoin legal tender and require businesses to accept it.

Then, in January 2022, the IMF Executive Board “urged” El Salvador to abandon making Bitcoin a legal tender along with calls for stricter regulation of the country’s wallet.

“IMF board members ‘urged the authorities to narrow the scope of the Bitcoin law by removing bitcoin’s legal tender status,’” the IMF said in a statement following a yearly consultation,” according to a January 25, 2022 Reuters article.

In contrast to Argentina, El Salvador defied the IMF and, despite a whole-of-institution pressure campaign about the risks of El Salvador’s move, the country is thriving.

As the news about Argentina’s bailout hit on April 24, Bitcoiners in El Salvador took a victory lap.

“Also a year ago, the IMF told El Salvador to stop using bitcoin and focus on fiat debt slavery. Yet it is Argentina that is defaulting today, while El Salvador paid off its bonds.”

So what about the U.S.?

Earlier this year, the Federal Reserve Bank announced the creation of the FedNow, “a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the US to provide safe and efficient instant payment services.”

The FedNow Service is expected to deploy in phases, with the initial launch in July 2023. This is the first step in the US towards a Central Bank Digital Currency.

“While the Federal Reserve has made no decisions on whether to pursue or implement a central bank digital currency, or CBDC, we have been exploring the potential benefits and risks of CBDCs from a variety of angles, including through technological research and experimentation. Our key focus is on whether and how a CBDC could improve on an already safe and efficient US domestic payments system.”

The Federal Reserve published an exploratory paper on January 20, 2022, and the evolution of the US domestic payments system is coming in July with FedNow.

The US could go the way of El Salvador and unwind our economy and financial systems from the mutually assured economic destruction of the private central banks.

But that would require adults in the room, working on behalf of the American people.

That is highly unlikely in the Biden Administration, and everyone I’ve spoken to in this community expects high levels of pain ahead.

There’s Nowhere Left to Go

Digitization of financial assets is a revolution. Many in the community realize that, but many are just in it to make money. There’s nothing wrong with that, of course, unless you’re misleading investors and engaging in fraud to make that money.

Still, both populations comprise a small group of American early adopters—a pilot program—for one of the most transformative and impactful moments in money since the 1910 meeting on Jekyll Island.

Can Bitcoin free the people from the regime and its private banking cartel? Or will American apathy, wild west scamming, and human greed and hunger for power accelerate the Great Reset to the New World Order?

For GMoney, it comes down to personal responsibility:

“Everybody gets Bitcoin at the price they deserve, so ignore it at your own peril. Adapt or perish, there’s no other way to put it.”

Matta is also optimistic, and both gentlemen were firm in clarifying:

“Bitcoin, not crypto.”

Like GMoney, Matta’s optimism also stems from his belief in human agency and personal responsibility, saying, “With great reward comes great responsibility. The longer you take to educate yourself and get up to speed, the only person you are doing a disservice to yourself is you.”

Of course, human agency and personal responsibility requires informed investing and doing your own research and due diligence.

“Think back to the first time you heard about bitcoin. What if you would have invested then? How much better would your life be today? The same will be true five years from now.

It’s definitely a painful learning curve, but once you fully understand crypto, you will 100% see the major issues with banks and traditional markets.” —Ryan Matta

I have no trouble seeing the major issues with banks and traditional markets. But from Solana to Saitama, from wild west, low-level scammers to the IMF setting nation-state monetary policy that restricts the freedoms of the people, it’s hard for me to see the promised utopia.

But I want to.

I’m still skeptical, but if my research has taught me anything, it’s that the revolution will continue whether I believe it or not.

As GMoney says:

“Nobody is going to hand you your freedom. You have to take it.”

Ashe in America hosts Culture of Change on Badlands Media, Sundays at 6PM ET. If you enjoyed this contribution to Badlands Media, please consider checking out more of her work for free at Ashe in America.

I must confess that I still don't understand anything about this subject, far too virtual and non-concrete for my taste...

That's why I still prefer to handle a currency even if it's imperfect if it remains tangible.

I probably am not the only one, even among people who have a good technical and high-tech culture!

May God help us and bless us ! 🙏🏻✝️

🇫🇷 🕊️ 🇺🇲

How do you give Bitcoin to a homeless person begging for help on the street and what does Bitcoin mean to someone who thinks they've escaped the matrix living off the grid? A virtual cashless society is just a stupid and dangerous idea.