Badlands Media will always put out our content for free, but you can support us by becoming a paid subscriber to this newsletter. Help our collective of citizen journalists take back the narrative from the MSM. We are the news now.

The entire global banking system is about to change.

It’s already in progress. It has actually been happening for several years now and is going to completely revolutionize banking as we know it. I truly think people are underestimating what’s coming.

My previous article focused on the global financial system. In this article, I would like to focus on how banking itself is going to change and the financial freedom it will give us all as individuals.

What is the one thing that is required in a global financial system?

It’s also the most important thing when it comes to banking.

Everything connected to banking is dependent on this one thing, and at the same time it’s also the banks biggest vulnerability.

What is it?

Trust

noun

reliance on the integrity, strength, ability, surety, etc., of a person or thing; confidence.

verb

to rely upon or place confidence in someone or something.

Do you have “confidence” in the banking system?

Trust is an important thing when it comes to banking.

Why?

A lack of trust is what makes banks vulnerable to bank runs and a possible failure.

“You cannot have an honest economy without an honest financial system and honest money.” — Bob Moriarty

Our entire financial system has become CENTRALIZED and controlled from the top to the bottom. A cabal of elite bankers own and control our currency. They also own and control our governments and use their puppet politicians to pass laws that only benefit them.

Centralize

‘To concentrate by placing power and authority in a central organization.’

This is why the ones with power over the financial system are called “Central” banks.

The number of banks across the country has been declining for decades, which is causing more centralization in the banking industry. With a fewer number of banks, there are also fewer opportunities and choices for small businesses, farmers and first time home buyers.

How do you change the banking system?

How do you give power back to the people?

You decentralize the financial system and create competition.

You give the people the power to choose.

There is a huge paradigm shift in banking happening before our eyes and most people are missing it. It’s ultimately about changing who has the power over your personal finances. Is it you, or the banks?

It’s also about who controls the financial system.

Have you heard of the term FinTech?

According to Investopedia:

Financial technology (better known as Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services. At its core, fintech is utilized to help companies, business owners, and consumers better manage their financial operations, processes, and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones.

When fintech emerged in the 21st century, the term was initially applied to the technology employed at the back-end systems of established financial institutions. Since then, however, there has been a shift to more consumer-oriented services and therefore a more consumer-oriented definition.

FinTech was first used to help streamline and cut costs on the backend of financial institutions. Now it is taking the lead in providing new technology on the front end in order to directly serve customers, making their lives not only easier, but offering them more control of their finances by creating competition for the big legacy banks when it comes to financial services.

What has caused FinTech to shift from backend applications to customer oriented applications?

There’s been a huge shift from the internet revolution into the smart-phone revolution. More and more people nowadays are using their phones to do their personal banking and for a good reason.

Banking is going digital.

Digital banks and financial services are disrupting the control that central banks have had for many generations.

The financial services these companies are offering at peoples fingertips are not only convenient, but often come at competitive rates and many come without fees.

What kind of financial services do these FinTech companies offer?

From the same Investopedia article:

Fintech now describes a variety of financial activities, such as money transfers, depositing a check with your smartphone, bypassing a bank branch to apply for credit, raising money for a business startup, or managing your investments, generally without the assistance of a person. According to EY's 2017 Fintech Adoption Index, one-third of consumers utilize at least two or more fintech services and those consumers are also increasingly aware of fintech as a part of their daily lives.

“One-third of consumers utilize at least two or more fintech services.”

That number is predicted to grow at a rapid pace. Competition is a great thing if you want to give the power back to the people. FinTech allows financial companies to lower their operating costs and become more efficient, ultimately leading to better services for their customers.

These FinTech companies aren’t just bypassing legacy banks; they are also competing with credit card companies.

Companies are offering peer-to-peer payment services that allow people to send money through their phone directly to another person in just moments, using just an email or phone number.

Peer-to-Peer (P2P).

How important is this to decentralization of the banking system?

According to Investopedia:

What Is a Peer-to-Peer (P2P) Service?

A peer-to-peer (P2P) service is a decentralized platform whereby two individuals interact directly with each other, without intermediation by a third party. Instead, the buyer and the seller transact directly with each other via the P2P service. The P2P platform may provide services such as search, screening, rating, payment processing, or escrow.

This P2P service allows people to interact and send money to each other without permission from third party intermediaries. This puts the power in the hands of the people.

There’s a very well known company that was one of the first companies to offer P2P payment services over the internet. This company helped launch e-commerce because it could transfer payments securely instead of mailing checks.

Have you heard of PayPal?

Elon Musk

The Visionary Disruptor.

Many remember Elon Musk as a cofounder of PayPal, which was one of the first online payment systems that allowed people to pay for transactions, receive payments and send money to people. It is now one of the most used payment systems in the world.

But Elon was trying to create something much bigger that I think most people have forgotten about.

X.com

Before PayPal, Elon created an online bank called X.com.

According to CBS Market Watch:

Taking advantage of new reforms in the banking industry, and innovations offered through the Internet, Musk set out to a develop a new financial services concern that marries banking and mutual fund management. The outcome of his efforts took just six months.

Besides offering the first seamless integration of banking and mutual fund purchases on the Net, Musk hopes to make a name for his company as the low-cost leader in the mutual fund industry. Not only does he have a no-load, no-cost -- free from fees of any kind -- S&P 500 index fund, but he's actually paying shareholders a small amount to participate.

Elon was trying to create an online bank that charged no fees and was even paying shareholders to participate. This was way back in 1999. He was way ahead of his time, already wanting to compete with the big banks and offer the people more choices.

From that same article:

CBS.MW: Could you speak to us a little bit about the genesis of X.com?

Elon Musk: I sold my last company to Compaq in April of this year. I knew at the time I wanted to go and do something else, and I thought the opportunity was really terrific for a main-stream financial services play. In my view, the Internet had gone through a couple of stages and was ready for another stage.

The first stage was where people could trust the Internet for information. This was perhaps '95 or '96. The second was to trust the Internet for purchases and begin to use credit cards online to buy books, toys, pet food and that kind of thing.

I think we're at the third stage now where people are ready to use the internet as their main financial repository.

X.com would merge with a software company called Confinity Inc., which had a great online payment system. Elon wanted his digital bank to compete with the legacy banks, but other leaders of the company wanted to go in a different direction, so they removed him as CEO then named the company PayPal, focusing on becoming a global payment system instead.

Elon has talked several times about how his vision of PayPal was a missed opportunity.

“Like, I think if PayPal had executed the plan that I wanted to execute on, I think they would probably be the most valuable company in the world. Would be called “X”, but it would be the most valuable company in the world.” — Elon Musk

I believe Elon is in the process of executing that plan once again.

What is interesting are the things Elon has been doing recently, which seem to be pointing towards him trying to recreate that digital bank that he tried to build many years ago.

For example: he’s recently purchased Twitter which has over 350 million users. He’s taken it private, which is important because he controls the direction of the company, instead of a board of directors or big investors. He’s trying to remove the bots along with ending censorship, which has gained him much support amongst patriots. He’s also exposing the enemy’s crimes on Twitter.

But he’s done something a lot more interesting that many people don’t know about.

According to the Washington Examiner:

Twitter filed paperwork with the Treasury Department to enter the payment processing business, expanding Elon Musk's vision for the company.

The social media platform filed registration paperwork last week with Treasury's Financial Crimes Enforcement Network, according to the New York Times. This paperwork is necessary for any business that wants to be involved in money transfers, currency, and exchanges. Musk's decision to move Twitter into the financial technology industry echoes his past at PayPal and his interest in replicating the Chinese social app WeChat.

Elon has big plans. He doesn’t see things the way most people do. He see’s future possibilities and has the drive to make them happen, very similar to Donald Trump.

The Bank of Twitter

Set aside all of your preconceived perceptions of what Twitter is right now and think of what it could become. With a customer base of 350 million people, the opportunity to disrupt the centralized world of banking and compete with them is huge.

Is Elon serious about this?

According to The Financial Brand:

After he won the battle for Twitter, Musk held a town hall meeting with employees and sketched out possible plans in financial services, saying he envisions Twitter as “the people’s financial institution.”

More from The Financial Brand:

• The principle: Musk told staff that he sees payments as an exchange of information, with “not a huge difference” between just sending a direct message on Twitter and sending a payment. He said that the company will move towards enabling Twitter users to be able to send money to anyone, anywhere, “instantly and in real time.”

• The skeleton: “The full answer to the payment story is complicated,” Musk said. However, he spoke of a structure in which every verified Twitter user would get some money put into an account, which they could send anywhere. It’s almost like payments “cloud seeding.”

As Musk outlined the concept, deposits would be placed into a high-yield money market account. A positive balance would earn a higher rate than available elsewhere. Falling into a negative balance — or, in banking lingo, overdrawing an account — would result in a charge, but Musk contends it would be a lower amount than is typical for financial institutions.

Twitter accounts could include a debit card for transactions with merchants who don’t accept Twitter payments directly. In addition, customers who need some checks would be provided with them. Automatic payments would also be enabled.

• The teaser: Said an employee: “It sounds like more of a bank. Do you also foresee us loaning?” Musk: “Well, if you want to provide a comprehensive service to people, then you can’t be missing elements.”

Comprehensive service?

Elon has big plans. Not only has he applied for registration to the Treasury Department for a payment processing business, but he has also quietly purchased back the domain name X.com from PayPal.

Coincidence?

There’s another important thing I think Elon is doing that is directly tied to creating his digital bank connected to Twitter.

Starlink

Elon is trying his best to better the lives of humanity, especially those that have been victimized by the global cabal and kept in poverty. He open sources his technology purposely so that other companies can improve technology in order to innovate and make peoples lives better.

Starlink is offering high speed internet to remote and rural locations. It’s the opposite of what the cabal wants to do. They want to centralize us in large cities where they can control us.

How do you lift the large portion of the global population out of poverty?

You create the ability for them to control their own financial destiny and make their own choices by allowing them access to the internet so they can participate in the global economy no matter where they live. The entire world is going digital.

Elon is trying to make what he calls the global digital town square into the peoples financial institution.

Don’t miss that last part!

Elon said Twitter has tremendous potential and he wants to unlock it!

So if Elon wants to make Twitter a competitor to banks in order to give the power back to the people, how do you do that?

I think that problem is already being solved by someone I think is aligned with Elon in this important mission.

Who is it?

Jack Dorsey

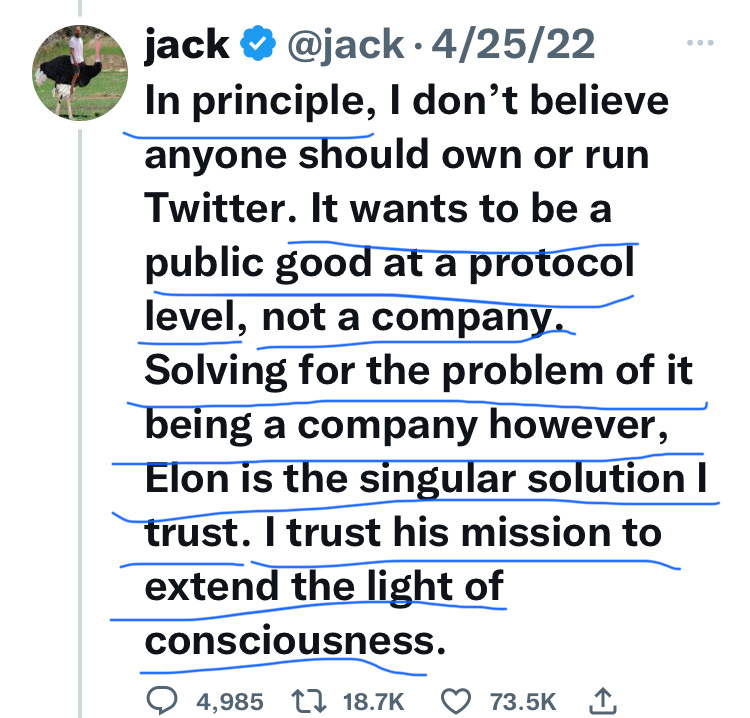

He has been vilified by right-wing news for many years now and blamed for all the censorship on Twitter that Elon is exposing.

I believe there’s lots of proof that Jack didn’t have control of Twitter and hasn’t for a long time. He’s stated that himself openly in response to Elon buying Twitter and taking it private.

He wants Twitter to be used for the public good and trusts Elon’s mission to do so. He said that Elon is the singular solution he trusts.

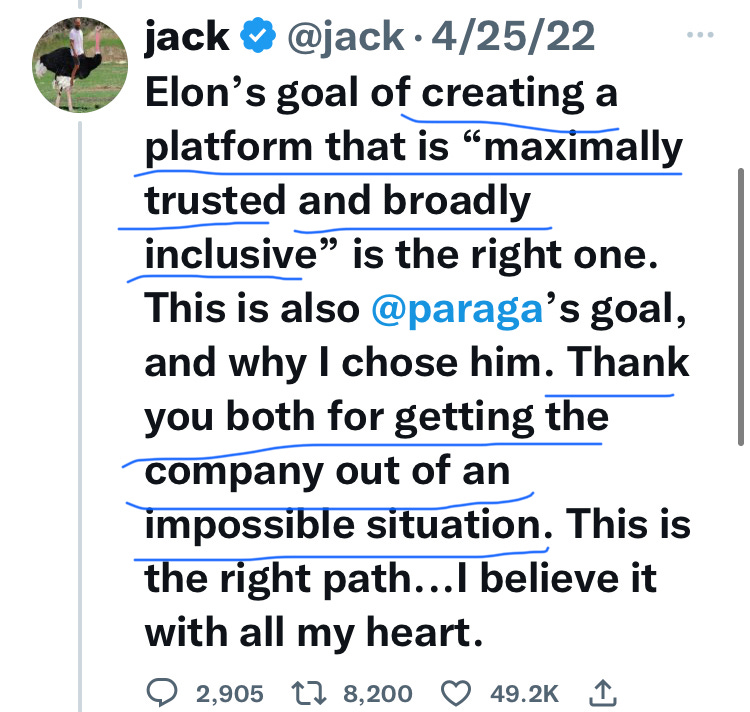

A platform that is maximally trusted and inclusive. Sounds like a bank that can be accessed almost anywhere in the world by Starlink.

What was the impossible situation Twitter was trapped in?

Dorsey didn’t control Twitter. I would argue that the cabal did and used it as one of their best weapons. I’ll make that case in a future article.

Dorsey is working hard to compete against the banks, too. He had the same vision for Twitter that Musk does, but he didn’t have control of the company.

According to The Financial Brand:

Twitter’s founder, Jack Dorsey, also founded Square, the payments company, since renamed Block, which includes the CashApp P2P service. Mikula notes that at one time Dorsey’s interest in payments and blockchain was so strong that many speculated he would merge Square with Twitter. In time, he delegated the leadership of Twitter to focus on Square.

What is Square?

According to Investopedia:

In 2009, entrepreneurs Jack Dorsey and Jim McKelvey created Square, Inc. (SQ), fulfilling their dream of creating technology capable of aggregating merchant services and mobile payments into a single, easy-to-use service. Less than a decade later, Square was used by millions of small businesses that use it to accept credit card payments, track sales and inventory, and obtain financing.

Square's product line includes Cash App, which allows users to send and receive money for free through a mobile application, and Square Point-of-Sale, a free application that lets merchants process payments via smartphone.

Vision Statement from Square

No one should be left out of the economy because the cost is too great or the technology too complex — Square Mission

Dorsey’s company was geared towards helping small businesses, which is the heart of the middle class and our economy. All of these services are accessible through a smartphone.

Like Musk, Dorsey also open sources his technology. Why? To invite other engineers to create and improve the services. They both share the community aspect of advancing technology in order to better humanity.

It was no surprise that Square rapidly expanded into other services and grew rapidly. Dorsey then renamed it Block.

What does Block offer?

Square - A card reader app for small businesses.

Square Suite - A suite of services for small businesses to easier manage finances and run their business.

Cash App - An app that allows consumers to invest, spend, send or store their money.

Bitcoin - Hardware wallet, mining business, open-source for developers called TBD and an independent business focused on Bitcoin called Spiral.

Tidal - Which helps musicians and artists control and monetize their own intellectual property using NFT’s.

According to Data Driven Investor:

He fully utilizes the platforms he has built — Twitter and Square to utilize Bitcoin’s potential fully. I believe this is what differentiates Square from other payment platforms like Visa and Paypal.

On Twitter, there is a strong relationship between fans and creators. Twitter encourages communication, Square facilitates payments, and Bitcoin is the engine. Anyone on the planet can earn a fair amount of money for their art through NFTs.

What started as a simple dongle (Square Reader) is now an entire ecosystem connecting and enabling people worldwide.

Can you see how this connects perfectly with a plan to create a digital town square and the peoples financial institution that Musk envisions? Can you see how they are both working to decentralize banking and give people more control?

What Is Financial Inclusion?

Financial inclusion is an effort to make everyday financial services available to more of the world's population at a reasonable cost.

Advancements in fintech, such as digital transactions, are making financial inclusion easier to achieve.

However, the World Bank estimates that some 1.7 billion adults worldwide still lack access to even a basic bank account.

Dorsey is on a mission to compete with banks.

According to Independent:

Block, the tech company co-founded by former Twitter chief executive Jack Dorsey, is looking to invest in a not-for-profit lender or social enterprise in Ireland.

Earlier this month, Block put £2m (€2.3m) of funding into ART Business Loans, a Birmingham-based community development finance institution (CDFI) lender which provides loans of £10,000-£150,000 to businesses unable to meet the full requirements from banks.

Bitcoin is also something that Dorsey is focusing on and for good reason.

According to Data Driven Investor:

Jack’s involvement with Bitcoin has been long, and it is clear that he doesn’t just see it as an investment opportunity. He is doing everything to accelerate innovation and accessibility in the cryptocurrency.

Blockchain is critical in creating open and honest banking practices by creating a recording of transactions that can be verified. No more hidden books and corruption in the banking system. Transactions are verified and ownership secured. It also creates a medium of exchange that can be done globally.

It’s a big part of the coming revolution in banking. Digital currency is not something to fear, but to welcome. We need honest money, honest transactions and honest bookkeeping.

But what is Dorsey’s biggest role in our financial freedom?

How do you give the power back to the people, especially in a digital world where banking is rapidly going digital?

Who controls your data?

In a rapidly-expanding digital world, whoever controls your data ultimately controls you, especially financially.

Our data is completely controlled by third parties. Banks control our financial data and use it to determine our credit worthiness in a global debt system. This data has also been shown many times to be vulnerable to hackers.

Here’s the paradigm shift that will completely change banking forever.

Instead of a bank controlling your data because you are forced to use their platforms and agree to their terms, much like social media, you will control your own financial data and be able to choose for yourself who can access it.

How do you decentralize banking forever?

How do you truly give the power back to the people?

Have you heard of Web5?

According to Builtin.com:

Just as we were getting used to the blockchain tech building the base ofWeb3, Twitter co-founder Jack Dorsey is proposing an alternate vision for a decentralized internet. Are you ready for Web5?

Web5 is a decentralized version of the internet where users store their own personal information and can revoke access at will. The brainchild of Twitter co-founder Jack Dorsey, it functions as a peer-to-peer system built on top of Bitcoin infrastructure.

Web5 is a decentralized vision of the web built entirely on the Bitcoin blockchain that aims to secure personal data by restoring the ownership of digital identity back to individual users. Practically speaking, it leverages the Bitcoin’s Lightning Network — a protocol that operates off of the main blockchain to allow rapid network functionality independent of tokens, transaction “gas” fees, trusted validators or additional consensus mechanisms — in order to create a peer-to-peer infrastructure of personal servers.

By positioning users as the sole managers of their data — encoded in a wallet stored on a node, or device — the choice to make personal data and information public, or revoke it, now lies with them.

Web5 is a decentralized, peer-to-peer network that specifically tries to create an internet free from centralization and censorship. The people control the servers that store data, not the corporations.

This is a complete revolution in how the financial system will work and who is in control.

Your personal data will now belong to you, not a third party. This not only gives you the control but also more privacy and security.

“The fundamental purpose of Web5 is to give users control over their data,” said Michael Pierce, CEO of NotCommon. “Essentially, the concept attempts to democratize the web by eliminating gatekeepers that effectively centralize technology.”

Like a globally unique username or digital passport, the protocol adapts easy sign-in authorization across applications, except the log-in information — often collecting last names, phone numbers and addresses — stays with the user.

You will keep and control your own personal data, login information and content with the power to choose who has access to it. No longer will corporations own your personal data or content.

Power back to the people.

Web5 components

Decentralized Identifiers: Unique, self-generated and self-owned identifiers which allow identity authentication and routing.

Verifiable Credentials: A proof or certificate secured by cryptography and created by multiple users that verifies a claim or interaction.

Decentralized Web Nodes: All the computers in the peer-to-peer network that act as servers storing data, relaying messages and making the decentralized apps work easier.

Web5 digital wallets

A Web3 wallet is used to hold your crypto currency, NFT’s or digital assets and is secured by encrypted private and public keys. It allows companies to collect your consumer data and there is a loss of privacy.

A Web5 wallet holds a user’s identity, data and authorizations for apps and are secured on a user’s personal nodal server. The user is the gatekeeper and has control, which protects privacy.

Can you see the huge paradigm shift that’s happening when it comes to banking and the advantages of the digital innovations on the horizon?

In my opinion, Musk and Dorsey are playing huge roles in giving the power back to the people, which has been a common thread for both of them.

The power is being placed back in the hands of the people through their smartphones in a rapidly increasing digital world. Freedom and control being restored to the people is how you decentralize banking forever.

In my last article in this series, I will share what I think this financial collapse will look like and why I don’t fear central bank digital currencies at all.

Badlands Media articles and features represent the opinions of the contributing authors and do not necessarily represent the views of Badlands Media itself.

If you enjoyed this contribution to Badlands Media, please consider checking out more of my work for free at Joe Lange’s Substack.

Sounds really nice and cool, BUT, what happens when the central banking cabal uses its lobbying powers to make such a system illegal? They are trying right now to get legislation passed in quite a few states. Also, what happens if the internet is down because of cyber attacks? I think we need a physical option. Cash is king.

Wow Joe... I can't thank you enough for this! I had no idea. Will have to re-read to absorb this. You answered so many questions, however... now I have many more! Looking forward to the next chapter. Thank you!