The Midas Touch

Everything Trump Touches, Turns To Gold

Badlands Media will always put out our content for free, but you can support us by becoming a paid subscriber to this newsletter. Help our collective of citizen journalists take back the narrative from the MSM. We are the news now.

Who controls the assets?

Whoever controls the assets will control the coming global reset.

There is a real war waging, and it’s being waged on multiple fronts. None more important than the war being waged for control of the global financial system.

A “Great Reset” is coming financially.

One side or the other will win this war. I’ve been making the case in my articles that we are not only winning the war, but are going to ultimately be victorious.

Trump’s Great Reset will give the power back to the people.

It’s a war over assets and who controls them.

The World Economic Forum, in an advertising video on one of their predictions for the future, laid down a marker for what their “Great Reset” would look like.

According to The Independent:

Within 13 years the culture of ownership will have changed dramatically and people will simply not buy stuff the way they do today. That’s the conclusion of a contributor to the World Economic Forum, who has predicted that by 2030 we will no longer own “stuff” but rather rent it.

They are pushing for an economy, where instead of people owning things, they rent them. They try their best to make it sound good by using the term “shared economy.” That’s an economy where we are no longer focused on consumerism, but instead rent things when we need them.

What’s the problem with this “shared economy”?

What aren’t they mentioning?

You won’t be able to afford to buy anything, so you’ll be forced to rent what you need. They will own all the assets, while our money will have lost all of its value.

What is value?

Value

noun

relative worth, merit, or importance:

monetary or material worth, as in commerce or trade

the worth of something in terms of the amount of other things for which it can be exchanged or in terms of some medium of exchange.

equivalent worth or return in money, material, services, etc

The value of something all depends on what it is worth. The more it’s worth, the more valuable it is.

Have you heard of the term “store of value?”

According to CorporateFinanceInstitute.com:

What is a Store of Value?

A store of value is an asset, currency, or commodity that maintains its value over a long period. An item would be considered a store of value if its value is either stable or increases over time but doesn’t depreciate.

If an item can be held and converted into money in the future without a decrease in value, it is considered a good store of value. Various commodities are considered stores of value by virtue of their divisibility, durability, and portability.

Gold is regarded as the ultimate safe-haven asset since its store of value does not deteriorate in an economic crisis, is always in demand and is easily convertible.

The cabal has always known what the one true store of value is.

Trump also knows what the one true store of value is.

This is the key: It’s a fight over the real assets.

What is the “ultimate safe-haven asset?”

Is it gold or the U.S. dollar?

“under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth... The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit ... “

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.” —Alan Greenspan

Inflation discourages savings, which is why the savings rate is really low in this country. You lose value by keeping money in a savings deposit, because the interest you earn is way below the inflation rate.

People can’t save money when the cost of living keeps going up because of constantly-rising inflation. It has also exploded credit card debt, which is a sign of the people struggling to meet their needs.

How do we change things?

What will give the power back to the people?

A return to the gold standard.

What will returning to the gold standard do?

Restore value in our currency.

Prevent inflation.

Encourage savings.

Restore trust in banking.

Prevent deficit spending

Decentralize the global financial system.

Gold is the key to decentralizing the entire global debt system.

Do you know who has loved gold for a long time and spoken often of going back to a gold standard?

There was something that happened way back in 2011, long before Trump ever announced that he was running for president.

I bet most people don’t know anything about it.

A lot of what Trump does is very purposeful. This event is no exception.

What was it?

Donald Trump Accepts Gold As Deposit From New Tenant

According to Fox Business:

"The rent’s too damn high," to quote Jimmy McMillan, former New York State gubernatorial candidate.

And for Donald Trump, that’s true when it comes to rent in cold hard dollars, given his sharp criticisms of the Federal Reserve’s open fire hydrant of dollar printing and the Obama Administration’s fiscal policies.

Trump said in a statement: "It's a sad day when a large property owner starts accepting gold instead of the dollar. The economy is bad, and Obama's not protecting the dollar at all ... If I do this, other people are going to start doing it, and maybe we'll see some changes."

Trump was pointing out the danger of the Fed printing money and the value of gold over the dollar way back in 2011.

How much does Trump like gold?

Here’s the opinion of some Bloomberg analysts.

Trump has always loved gold, and I believe there’s a good reason.

But how serious is Trump about returning to a gold standard?

He chose Judy Shelton as part of his economic transition team when he was elected. She has been advocating for the gold standard for a long time. He then nominated her for a seat on the Federal Reserve’s Board of Governors. She isn’t just a promoter of the gold standard, she’s also an outspoken critic of the Federal Reserve, which is probably why her nomination was blocked.

Here’s Judy Shelton talking about a return to sound money.

We need to go back to a gold standard, with a dollar measured in a specific amount of gold or silver because we can’t have an honest financial system without honest money.

Along with Judy Shelton, Trump was also meeting with John Allison during his transition. Some thought he was in the running for Secretary of the Treasury.

Who is John Allison?

He was head of the BB&T bank based in North Carolina for 19 years and then became head of the Libertarian think tank Cato Institute from 2012 to 2015.

Here’s what he wrote in the Cato Journal in 2014:

I would get rid of the Federal Reserve because the volatility in the economy is primarily caused by the Fed. Sound money matters. When the Fed is radically changing the money supply, distorting interest rates, and overregulating the financial sector, it makes rational economic calculation difficult. Markets do form bubbles, but the Fed makes them worse.

We need a private, free-banking system based on a market standard such as gold. If the United States had continued with the classical gold standard instead of having instituted a government money monopoly in 1913, we would have learned through experimentation, as all markets do, and would have a radically better financial system and higher economic growth today.

Trump was meeting with several key people who had a few things in common: A return to the gold standard and getting rid of the Federal Reserve.

Then in Trump’s first year in office there was something that happened that had not happened since 1948.

It caught a lot of people by surprise.

According to The Washington Free Beacon:

Steven Mnuchin will become only the third treasury secretary to visit the United States Bullion Depository at Fort Knox, Ky. on Monday.

Visits to the classified facility, built in 1936, are extremely rare due to security reasons. In 1974, the Mint gave a tour of the facility to select members of Congress to quell rumors that there was not actually any gold in the facility.

The total value of the Bullion Depository's contents is valued at approximately $200 billion, but the last time it was counted was in 1953, according to Mnuchin.

Why was this event so important?

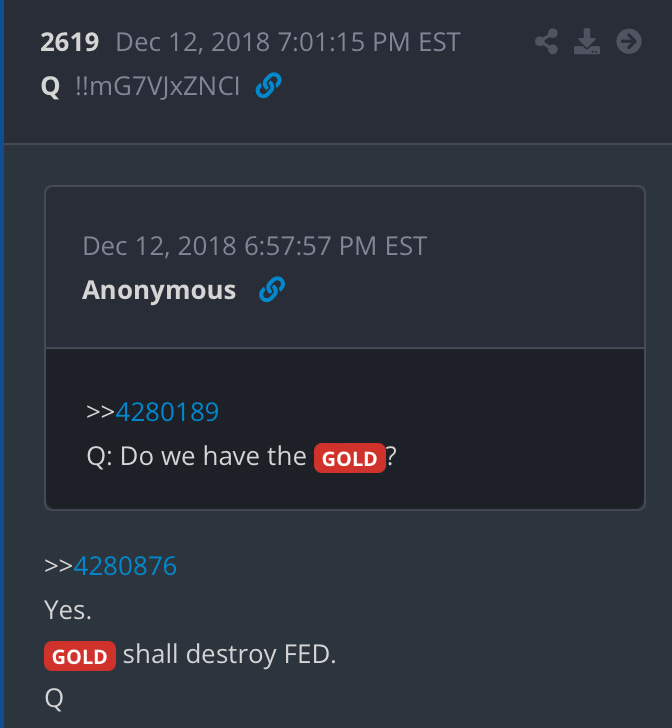

Q was asked, “Do we have the gold?”

Q answered “Yes.”

If you want to go back to a gold standard, you have to make sure you have the gold.

What other signs of a return to the gold standard are happening?

Gold repatriation.

According to CNN:

Germany's got its gold back.

The country's central bank announced Wednesday it has completed a program to repatriate gold bars worth nearly $31 billion from storage locations in New York and Paris.

Germany has been bringing gold home to Frankfurt from the two cities since 2013. The final 100 tons were moved from Paris earlier this year, the central bank said.

In total, 743 tons have been transferred. The project was completed three years ahead of schedule.

Many countries have repatriated their gold reserves back home, and it accelerated while Trump was president. They have gotten their gold back from the New York Federal Reserve, London and Paris, where a large number of countries held their gold reserves for both safe keeping and in order to use those gold reserves for currency exchange, leasing and collateral.

Which countries have repatriated gold?

Germany, France, Poland, Turkey, Austria, Netherlands, Hungary, Italy, Venezuela, Romania, Iran, Serbia, Slovakia and Belgium.

This is a huge deal.

Why were these central banks repatriating their gold?

From Bullionstar:

Many of these countries repatriated their gold because of public pressure, and they no longer trusted the central banks holding all the gold in London, New York and Paris. The gold is no longer held in centralized locations. Every country is taking control of its own gold, which is a good thing. Having the gold stored in centralized locations made it much easier for the cabal to manipulate the gold price.

What else is happening?

Central banks are purchasing gold in record amounts and have been for years now.

Why?

Bullionstar actually asked each central bank why they held gold:

In their own words, the reasons central banks hold gold in large quantities are many fold, however there are consistent themes in the central banks’ explanations. Many of the respondents cited gold’s ability to be mobilized in a crisis, that ‘gold holdings can be activated in an emergency’, that gold is an ‘emergency reserve in a crisis’, ‘a contingency against unforeseen events’, a form of ‘insurance’, or as the Bank of England says ‘a war chest’ and the ‘ultimate asset to hold in an emergency’. As such, nearly all central banks referred to gold as a safe haven asset.

Many central banks mentioned gold’s high liquidity, and some referred to the ability to use their gold to raise liquidity in a foreign currency, even for foreign exchange intervention.

Gold’s role as a hedge against inflation was cited in a number of the central bank answers, which explains why central banks look to the gold price as a barometer of inflation expectations.

Many of the banks also pointed out that because of the unique attributes of physical gold, such as limited supply and mined into existence, gold does not have any counterparty risk or credit risk, and because it is not issued by governments, it has no default risk.

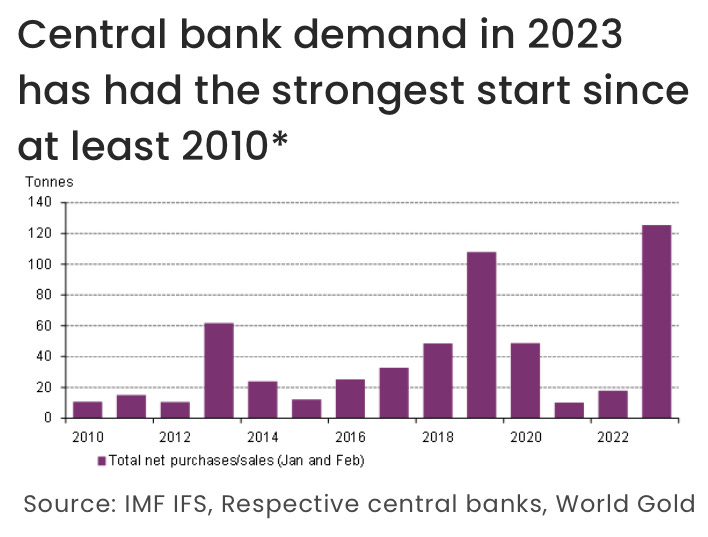

What’s happened this year?

According to US Global Investors:

Central banks accumulated gold at the fastest pace on record in the first two months of 2023, according to a report by the World Gold Council’s (WGC) Krishan Gopaul. In January and February, central banks collectively bought a net 125 tonnes of the metal, the highest amount for the year-to-date period since banks became net buyers in 2010.

Central banks are buying gold for a reason, they know a monetary reset is coming. They are purchasing record amounts of gold and taking possession of it, not keeping it in centralized locations controlled by the cabal anymore.

What else is happening?

The BIS (Bank of International Settlement) moved gold from a tier 3 asset to a tier 1 asset, making it equal to money.

BIS is the central bank for central banks. The entire system was centralized and controlled.

The Basel Committee on Banking Standards (BCBS) makes the rules for the global financial debt system, and this decision to move gold into the tier 1 asset class happened back in 2019.

According to the Pinnacle Digest:

In some respects, gold is now on the same playing level as the U.S. dollar and other currencies. Its previous 50% risk weighting assessment is no more. Gold, in effect, is money. Becoming a tier one asset should entice central banks, financial institutions and investors to add gold (and in some cases gold stocks) to their portfolios as a hedge (at a minimum) during uncertain times.

Central banks began purchasing large amounts of gold starting back in 2010 after the 2008 housing bubble and credit crisis, but after this decision by the BIS in 2019, a lot of central banks around the world began buying record amounts of gold.

There is a serious gold rush happening around the world. The global debt slavery system that has been run with fiat currencies is coming to an end, and everyone knows it. They all know a global financial reset is coming and they all want to have gold on hand rather than in centralized locations. Gold is now considered a tier one asset for the first time in a long time, which means that even the cabal knows the game is up and the value of the dollar is going to drop, along with all fiat currencies. They don’t want to be left holding the bag of fiat currencies that have no value, so they are buying gold, the one safe haven in a financial crisis and the only store of value.

What else is happening?

Is the United States moving toward a return to the gold standard?

According to MoneyMetals.com:

Mississippi Becomes the 43rd State to End Sales Taxes on Gold and Silver

Senate Bill 2862, sponsored by Sen. Juan Barnett (D-34), had passed out of the full senate by a vote of 52-0 and sailed through the House of Representatives by a vote of 115-0. The effective date is July 1, 2023.

Backed by the Sound Money Defense League, Money Metals Exchange, and in-state Mississippi dealers and investors, this year's legislative effort built upon a multi-year grassroots campaign waged by sound money activists.

Why is it important to remove the state sales tax on precious metals?

By taxing gold and silver, you discourage people from purchasing it and from protecting their savings against the devaluation of the dollar. Gold has always been a hedge against inflation, and many states are now encouraging their citizens to buy gold. Plus, states don’t tax other investments like stocks and bonds, so why should they tax gold as an investment? More importantly, by removing the sales tax on gold and silver, it’s being treated like money instead of a commodity. Almost every state has suddenly removed this tax on gold and silver. The seven states that haven’t are New Mexico, Hawaii, Wisconsin, Kentucky, Maine, New Jersey, and Vermont.

Why have 43 states removed the taxes on gold and silver?

Removing the taxes on gold and silver is the first step in making it legal tender so that it can compete with the fiat Federal Reserve Note.

Gold and silver as legal tender.

According to Bitcoin.com:

The state of Arkansas has moved to make gold and silver function as legal tender in its territories. The “Arkansas Legal Tender Act,” signed by Arkansas Governor Sarah Huckabee Sanders on April 11, explicitly mentions that gold and silver “specie” (meaning any kind of bullion or coin containing these materials) can be used to pay for debts.

The act also specifies that “specie or legal tender shall not be characterized as personal property for taxation or regulatory purposes,” and that “the purchase, sale, or exchange of any type or form of specie shall not give rise to any tax liability.”

Arkansas became the fourth state to make gold and silver coins legal tender. The other three states are Utah, Wyoming and Oklahoma. This is a growing movement because suddenly, many states are moving to do the same thing. There’s a gold rush happening in the states and it’s accelerating.

According to the same article:

23 states are currently developing regulations that will also allow their citizens to use gold and silver as legal tender, according to the Tenth Amendment Center, a federalism advocacy organization. Michael Marrahey, communications director for the Tenth Amendment Center, believes this is an initiative to undermine the powers of the U.S. Federal Reserve, noting that states are “nullifying the Fed on a state-by-state level.”

Can you see what is happening? Can you see the plan?

This isn’t just about getting rid of the Federal Reserve and fiat currency. That is going to happen. What’s happening in the states is a plan to prevent another central bank and fiat currency in the future.

How do you prevent another central bank in the future?

You decentralize money by restoring states rights over currency. You let the states’ gold and silver coins compete with the rapidly devaluing Federal Reserve Note.

The article continues:

The theory behind this idea is that in a multicurrency environment, the better currency will be the one that prevails. In this sense, constitutional tender expert professor William Greene explains:

“Over time, as residents of the state use both Federal Reserve notes and silver and gold coins, the fact that the coins hold their value more than Federal Reserve notes do will lead to a “reverse Gresham’s Law” effect, where good money (gold and silver coins) will drive out bad money (Federal Reserve notes).”

The debate of making gold and silver legal tender comes from way back, with experts stating this possibility is enshrined in the U.S. Constitution, which states that “no state shall … make anything but gold and silver coin a tender in payment of debts.”

Did you catch that last part?

“No state shall make anything but gold and silver coin a tender in payment of debts.”

That’s in the constitution, and we need to go back to the original constitution when it comes to our money.

The states are leading the charge to decentralize our country’s financial system, and they are using gold and silver to do it. Sound money, by definition, is only money backed by gold and silver, according to the constitution. Legal tender under the constitution is only gold or silver coins with an exact weight of measure, or notes fully backed and redeemable with gold or silver. We are already in the process of returning to that honest money standard.

According to a great and informative article written by Dean Clancy, The Constitution’s Five Monetary Rules:

Read in conjunction with the Ninth and Tenth Amendments, and the obligation-of-contracts clause (Art. I, sec. 10, cl. 1), we can identify five monetary policies that are constitutionally requisite in the United States:

The basic unit is the dollar, a silver coin containing 371.25 grains of pure silver.

Only gold or silver coins and currency (specie-backed banknotes) can be legal tender.

No state may issue coins or currency.

No one may counterfeit U.S. Government-issued coins or currency.

Fiat money notes (‘bills of credit’) are forbidden.

The term ‘currency,’ as I use it here, is synonymous with banknotes, paper money. When banknotes are backed by specie or some other commodity, they may be regarded as honest money. When unbacked by anything of value, they are typically called ‘fiat money.’ The Constitution refers to them as ‘bills of credit.’ Such money is forbidden. Neither the federal or state governments may issue it.

Federal Reserve Notes are bills of credit, which the Constitution forbids. Therefore, they cannot be legal tender.

Which brings us to the rule: Only gold and silver coins, and notes freely redeemable in and fully backed by such coins, may serve as legal tender in the United States. The Founders did not legislate this rule by accident, they put it in the Constitution knowing very well what they were doing. Honest money is not just a good idea, it’s the law.

So what else is happening in the states to move us back to a gold standard?

In my home state of Texas, the government moved many years ago to protect the gold and silver of its citizens by building their own gold bullion depository. It opened in 2018 and citizens can store their precious metals in the secure state government depository. It also allows the state of Texas to keep its own gold emergency reserves secure within its state borders.

The state has full control over their gold reserves, which makes them more independent and less controlled by the federal government. There’s a reason many of us who live here call it “the Republic of Texas.”

Here’s a short video talking about the Texas bullion depository:

In Tennessee, they are following in Texas’ footsteps.

According to Tenth Amendment Center:

NASHVILLE, Tenn. (Feb. 6, 2023) – A bill filed in the Tennessee House would establish a precious metals bullion depository. This would not only create a safe place to store precious metals; it also has the potential to facilitate the everyday use of gold and silver in financial transactions in the Volunteer State and set the stage to undermine the Federal Reserve’s monopoly on money.

Don’t miss that last part. This is what all these new laws being passed in the states are about. The states are undermining the Federal Reserve’s monopoly on money by going back to a gold standard.

But Tennessee has gone one step further. They’ve also passed a law authorizing the state government to purchase gold and silver for their reserves.

Why is this important?

According to another Tenth Amendment Center article:

NASHVILLE, Tenn. (March 24, 2023) – Yesterday, Tennessee Gov. Bill Lee signed a bill into law that creates a process for the state to buy, sell, and hold gold and silver. This sets a foundation for Tennessee to achieve more financial independence with gold and silver reserves, and could help undermine the Federal Reserve’s monopoly on money.

IMPACT

Holding gold and silver will allow the state of Tennessee to shield its assets and hedge against rapidly depreciating Federal Reserve notes.

This is something you will see more states do in order to shield their emergency funds and pension systems from the devaluation of the dollar.

One of the things Trump has focused on from the beginning was protecting states rights and decentralizing power from Washington DC and the Federal government.

Can you see that there is a well-coordinated plan to return to a gold standard by many red states in this country?

States going back to a gold standard creates competition with the Fed, which is a great thing, but it’s not the main point of all of this.

What is?

How do you get rid of the Federal Reserve and its monopoly over money?

I believe this is all to set up a legal showdown in the courts. A fight between the states and the federal government on the constitutional definition of money.

In the past, we have had some Supreme Court decisions that have ruled in favor of the Fed’s monopoly on money. I believe those rulings were just as unconstitutional as Roe v. Wade and all the gun control laws that the Supreme Court has been reversing. For the first time in many generations we have a Supreme Court stacked with Originalists; they are purposely taking on all of these huge unconstitutional rulings from the past and are overturning them to set legal precedent.

Why not follow the same plan and overturn the past Supreme Court rulings that gave the Federal Reserve power and monopoly over our money, such as the Legal Tender Cases or the Gold Clause Cases?

The constitution is very clear on what money is. It is clearly defined as a measure of gold and silver. Our money is supposed to be backed by gold and silver by law, and it’s also supposed to be redeemable. Fiat money is unconstitutional and so is an all powerful central bank.

I think somewhere in the not too distant future, as the dollar devaluation accelerates, we are going to see a showdown at the Supreme Court to overturn this fiat money monopoly and restore the constitutional standard of what real money is.

I believe the Supreme Court will rule on the side of the states and return the country to a gold standard. The states will exercise their constitutional rights to make sure we stay on a gold standard, which will prevent the centralization of our money supply in the future.

Trump made it a priority to flip the courts for many reasons; this might be one of the bigger ones.

In my next article, I will focus on CBDCs, what the plan is and why I don’t fear them at all.

Badlands Media articles and features represent the opinions of the contributing authors and do not necessarily represent the views of Badlands Media itself.

If you enjoyed this contribution to Badlands Media, please consider checking out more of my work for free at Joe Lange’s Substack.

It is a big mistake to say fiat currency isn’t backed by anything. The US dollar is backed by lies, terror, slaughter, murder, mass murder, and, ironically, the good faith of the people. You can’t eat gold. I advise backing BRICS with chocolate as well as gold.

There is a school of thought which believes the US Federal Reserve will be able to maintain financial stability of the global economy because it will simply provide an infinite amount of dollars whenever a crisis develops anywhere in the world.

Once the crisis has passed, the Fed will just suck all the extra dollars back out, to prevent hyperinflation from taking hold. They can repeat this process ad infinitum.

We are actually watching this dynamic taking place right now.

I believe the jury is currently out on whether deflation will follow the Fed policy of tightening. For example, egg prices have recently collapsed, adding to the rationale that widespread deflation is around the corner. Same beginning to happen in real estate.

By definition, such a process would temporarily reduce and then increase the buying power of the dollar. So the theory goes. We shall see.

What is ignored in this scenario is the subterranean global economic reform process which I believe is actually taking place to fully destroy the globalist fake free trade impoverishment regime and replace it with an enlightened mercantilism framework.

Given the two phenomena outlined above, which I believe will eventually have a confrontation, a return to some form of gold backed currencies around the world is inevitable.

As such, while I am not giving financial advice, I personally strongly favor making gold a significant part of any prudent investment portfolio.